Timesheet Adjustment Entry Steps

When updating a timesheet, you must specify whether your input is “Actual” or “Incremental” for the current/previous adjustment.

Below is the difference:

1. Actual Input

Represents the total expected Pay Period / total present days of the month.

The application will automatically deduct the previously processed Pay Period, and only the differential days will be considered for Payroll processing.

2. Incremental Input

Represents only the change in value, either an increase or decrease.

The application will consider only the incremental days for Payroll processing.

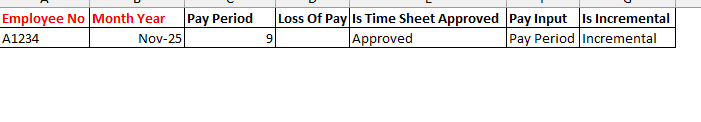

Example

Initial Timesheet Input:

Present days: 18 out of 31

Payroll processed based on these 18 days.

Revised Input Received Later:

Total present days updated to 27 days

If using “Actual” input:

You should enter 27 days as the Pay Period.

The system will subtract the previously processed 18 days and process the remaining differential (9 days).

If using “Incremental” input:

You should enter 9 days as the Pay Period.

(Because 18 days are already processed, and the new incremental value is 27 – 18 = 9)

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article